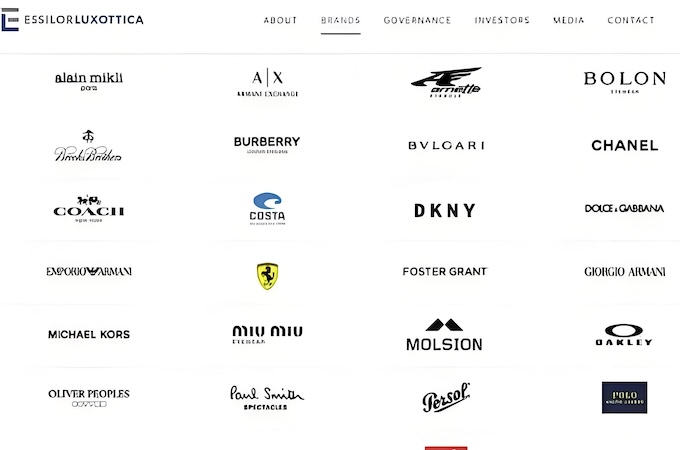

In the first half of 2024, the global eyewear industry showcased a diverse development trajectory. From high-end luxury brands to affordable eyewear retailers, the financial reports of various companies revealed different market dynamics. This article will comprehensively analyze the financial data of companies such as EssilorLuxottica, Safilo, Marcolin, Kering Eyewear, Fielmann, National Vision Holdings, Inc., Warby Parker, ARTS GROUP, and Dr. Glasses, exploring the growth drivers, challenges, and future development trends in the industry.

2. Safilo: Adjusting Amid Challenges In contrast to EssilorLuxottica’s steady growth, Safilo faced a decline in sales in the first half of 2024 (net sales in the first half of 2024 were €532 million, down 2.4% at constant exchange rates and 3.3% at current exchange rates. In the second quarter of 2024, Safilo’s net sales were €254.8 million, down 3.1% at both constant and current exchange rates). Despite this, the company achieved positive growth in its own brand Carrera and some core licensed brands. The decline in sales in the Asian market, especially outside China, indicated a need for the company to strengthen its market strategies in these regions (second-quarter sales in Asia were over €145 billion (-12.1%), and first-half sales were over €264 billion (-7.5%). Specifically, the Chinese market continued to show positive momentum thanks to PORTS and POLAROID, while sales trends in Southeast Asia were weak. The Carrera brand performed well in the U.S. market, along with some core licensed brands like David Beckham, Carolina Herrera, Marc Jacobs, and Tommy Hilfiger, all achieving double-digit growth in distribution volumes).

3. Marcolin: Seeking Stability Amidst Fluctuations Marcolin experienced a slight decline in revenue in the first half of 2024 (reporting revenue of €297.6 million, down 3.6% from the same period last year), but the company successfully consolidated its performance by improving marginal benefits. The Europe, Middle East, and Africa regions, along with the Americas, were its primary markets, while double-digit growth in the Asian market highlighted its potential in emerging markets (with main markets in Europe, the Middle East, and Africa, generating €149.6 million (+2.1%) and the Americas €106.6 million (-4.7%). The Asian market continued its growth trend in recent years, achieving double-digit growth in the first half).

4. Kering Eyewear: A Bright Spot in the Luxury Market Kering Eyewear delivered an impressive performance in the first half of 2024 (with revenue of €914 million, reporting a 5% growth), outpacing other brands within the group (Kering Eyewear and corporate divisions reported revenues of €1.1 billion in the first half of 2024). This achievement was driven by the steady development of its brand portfolio. However, the overall decline in Kering Group’s revenue (Kering Group reported total revenue of €9 billion in the first half of 2024, down 11% on both a reported and comparable basis. In the second quarter of 2024, revenue totaled €4.5 billion, down 11% on both a reported and comparable basis, with Gucci’s revenue down €4.1 billion, reported down 20%, and comparable down 18%; Bottega Veneta reported record first-half revenue of €836 million, flat on a reported basis, and up 3% on a comparable basis; Yves Saint Laurent’s first-half revenue in 2024 was €1.4 billion, down 9% on a reported basis and 7% on a comparable basis; other brands reported first-half revenue of €1.7 billion, down 7% on a reported basis and 6% on a comparable basis), along with forecasts of potential revenue declines in the second half, suggests that the luxury market still faces challenges.

5. Fielmann: Strong Growth in International Markets German eyewear chain Fielmann saw significant growth in sales in the first half of 2024 (with group sales up 12% year-on-year and improved profitability. Fielmann stated that preliminary figures indicate group sales of approximately €1.1 billion in the first half of 2024, up 12% from the previous year’s €971 million), particularly in international markets. This growth indicates strong performance (with double-digit sales growth in Austria (10%), Spain (10%), and Poland (32%). Sales in Germany increased by 6%, while Switzerland grew by 5%. Fielmann expects group sales to reach €2.3 billion for the full year 2024, up 15% from last year). Despite challenges such as low consumer confidence, the company has managed to achieve growth through effective market strategies and brand positioning.

6. National Vision Holdings, Inc.: Growth Driven by New Stores As one of the largest eyewear retailers in the U.S., National Vision Holdings, Inc. saw its net income increase in the first half of 2024, primarily driven by new store openings and comparable store sales growth (with net income up 4.2% year-on-year to $934.5 million in the first half of 2024). This trend suggests that the expansion of physical retail stores remains a key driver of growth.

7. Warby Parker: Success of the DTC Model The DTC (Direct-to-Consumer) eyewear brand Warby Parker achieved significant revenue growth in the second quarter of 2024 (with net revenue up 13.3% year-on-year to $188.2 million in the second quarter of 2024; and net revenue up 14.85% year-on-year to $388.2 million in the first half of 2024), and plans to open more new stores in the second half of the year (with the company opening 11 new stores in the second quarter, bringing the total number of stores to 256, and plans to open 40 more new stores in the second half of the year). This strategy’s success demonstrates the strong viability of the DTC model in the eyewear industry.

9. ARTS GROUP and Dr. Glasses: Steady Growth in the Asian Market ARTS GROUP (with sales of HK$606.39 million in the first half of 2024) and Dr. Glasses (with operating income of approximately ¥601 million in the first half of 2024, up 0.34% year-on-year) both achieved sales growth in the first half of 2024, with significant contributions from the Asian market. This trend reflects the importance of the Asian market in the eyewear industry and the effectiveness of these companies’ market strategies in the region (with Dr. Glasses opening 28 new stores, including 19 directly operated stores and 9 franchised stores; closing 13 stores, all of which were directly operated. As of June 30, 2024, the company had a total of 530 stores, including 501 directly operated and 29 franchised).

The financial data from the first half of 2024 reveals diverse developments in the global eyewear industry; the sector has undergone a series of changes and challenges. From high-end luxury brands to affordable eyewear retailers, companies are striving for growth and adapting to market changes (from EssilorLuxottica’s acquisition strategy to Safilo’s market adjustments to Warby Parker’s DTC model). Despite challenges, the overall trend in the industry is positive, especially with the growth potential in the Asian market. Looking ahead, the eyewear industry needs to continue innovating, strengthening brand building, and adapting to digital and e-commerce trends to achieve sustainable growth.

Note: The above analysis is based on the provided financial data and represents the author’s personal views, not constituting investment advice.

Related article: 2024 China Optical Lens Manufacturers Industry Analysis Report